Send a message.

We’re here to answer any question you may have.

Careers

Would you like to join our growing team?

careers@hub.com

Feedbacks

Would you like to join our growing team?

info@hub.com

We’re here to answer any question you may have.

Would you like to join our growing team?

careers@hub.com

Would you like to join our growing team?

info@hub.com

Book a free Discovery Call and we will point you in the right direction with attractive discounts for your first year.

Lock in a good deal before it is too late.

Regular price €580

Regular price €870

We understand that time is of the essence for aspiring entrepreneurs. That's why we've designed our service to be remarkably efficient, enabling you to establish your company in a matter of minutes.

Once you have the perfect name selected, our offer encompasses everything you need to launch your Estonian company successfully. The first payment for starting package is 315 € + 195 € = 510 € and the recurring payment is 195 € / year.

- State fee coverage

- Business address in Tallinn's vibrant city center

- Contact person services for seamless communication

Our commitment to your success extends beyond company formation. We offer a comprehensive suite of business services tailored to e-residents, such as the Start Easy accounting solution.

Our direct connection to the Estonian Business Registry allows for a quick company formation so you can start your business activities as quick as possible.

Our comprehensive offer includes everything necessary for a successful launch of your Estonian company. This covers:

- State fee

- Business address in the heart of Tallinn

- Contact person services for smooth communication

We value custom accounting solutions based on every client’s needs. Starting a business in a different country requires knowledge of the country’s tax system and rules.

Start Easy accounting solution is crafted to streamline your financial operations, ensuring accuracy and compliance every step of the way. Let us handle the time-consuming tasks.

Our advanced accounting software automates routine processes, allowing you to focus on growing your business. With this offer, get your VAT registration for FREE (regular price €120)!

All your company’s letters will be uploaded in minutes and can be accessed through my1Office.

This allows you to view all the post that has arrived for your company, search for important documents, add comments or highlights for your business partners, and conveniently forward encrypted documents whenever needed.

All the expense documents can be managed from one place and you can easily create and send out sales invoices in multiple currencies with the My1Office app.

There are several options – you can use our accounting service with a dedicated accountant or opt in for the self-accounting solution and be your own accountant.

![]()

Revolut is renowned for its innovative features and flexibility. Business accounts offer easy currency exchange, expense tracking, and team management. With Revolut, businesses can issue corporate cards and seamlessly integrate financial tasks into daily operations.

![]()

The best everyday banking services – free transfers within Europe and a user-friendly internet bank and mobile app. Take your business to a new level – flexible financing products that meet your company’s needs. One system for processing all payments – convenient for you and your customers.

![]()

A free multi-currency account to send, spend and receive in over 40 currencies, with the real exchange rate. International payments are up to 14x cheaper than PayPal and you can receive international payments with zero fees. Account includes IBAN and debit card.

![]()

Payoneer excels in facilitating cross-border payments for businesses. The platform supports multiple currencies and offers a user-friendly interface. Payoneer's emphasis on global transactions makes it a go-to choice for businesses with an international footprint.

![]()

Airwallex is designed for businesses with a global outlook. This fintech platform streamlines cross-border transactions and offers virtual and physical corporate cards. Airwallex's integration capabilities make it suitable for businesses seeking a comprehensive financial solution.

![]()

Paysera's Business Account empowers businesses with multi-currency support, swift transactions, and a user-friendly interface. The platform's cost-effective solutions and integrated services make it a reliable choice for streamlined financial operations.

I was one of the first e-Residents, but taking the leap to start a company was still a bit daunting. After talking with 1Office at Latitude59, I made the jump, and they ensured that the process was painless. The support throughout the process was phenomenal.

Time is highly valuable. That's why we at Vee Security chose 1Office. Helping us with all legal paperwork. I personally as a CEO feel calm and confident, having 1Office backing our business in Estonia.

I live in Croatia and I'm proud of being an Estonian E-resident. I was very hesitant to start my limited company using an online company formation company. When I did a Google search I found many companies offering this service and luckily, I choose 1Office over others.

Highly recommended!! The service provided at 1Office Estonia can be described in one word- flawless. Their team helped guide me through the process of opening an Estonian corporation online with ease, knowledge, professionalism and a level of personal kindness that are unparalleled in their field.

We have used services of 1office before 2 years. Their advice in all realms of setting up a company, in terms of virtual office, legal and accounting, has been extremely valuable.

I am an Estonian citizen who runs his Estonian company from Spain with the help of 1Office. I set up Redisa OÜ in 2015 with the help of Katrin Allmäe of the Tallinn office, who was recommended to me by one of my business associates. Throughout our 3 year relationship, she and the rest of her colleagues have helped me resolve many business related and government administrative issues in a smooth fashion, allowing me to concentrate on growing my business.

I am very happy and satisfied with the Legal Consultation and Virtual Services from 1Office since 2016.

Before I choose 1Office, I got in touch with other Company’s too. But only 1Office offered me the best answers and solutions for my Situation. The Team are very competent and flexible and adjust their Service exact to my needs. I can fully recommend to doing business with them!

I am an Estonian E-resident from Austria and set up a company in Tallinn in 2015. Two years later I had to liquidate the company because of some unforeseen circumstances. I employed 1office with the liquidation and after helping me to create the final report they took care of the whole liquidation process.

Opening a company in Estonia as a foreigner involves a streamlined and digital process, largely facilitated by Estonia's e-residency program.

The first step is to apply for e-residency in Estonia. E-residency allows individuals to establish and manage a business online, without physically residing in the country. The application can be submitted online, and once approved, you'll receive a digital ID card that enables you to sign documents electronically.

After becoming an e-resident, you can choose a service provider to help establish and manage your company. My1Office is one such service provider that simplifies the process.

With your e-residency and chosen service provider, you can proceed to register your company online. My1Office, for example, provides a user-friendly platform that allows you to fill out the required forms, upload necessary documents, and complete the registration process with ease.

Once your company is registered, you'll need to open a business bank account. My1Office has partners such as LHV and Wise, who offer a great service to e-residents.

We have also recorded a webinar, where we explain the steps and requirements to open a company in Estonia and become an e-Resident.

Efficiently running a company in Estonia involves compliance with legal and regulatory standards while taking advantage of the country's digital infrastructure.

Understand and comply with Estonia's tax regulations. The country has a transparent and straightforward tax system, including a flat corporate income tax rate. Regularly file tax returns and meet deadlines to avoid penalties.

Fulfill annual reporting requirements, including submitting financial statements and reports to the Estonian Business Register. Keep accurate records of financial transactions and ensure compliance with accounting standards.

Service providers such as My1Office offers comprehensive solutions to small business owners by taking care of the required reporting and declarations so the business owner can focus more on business itself.

We have also recorded a webinar explaining some of the requirements in more detail.

Estonia's business environment is known for its innovation, digital infrastructure, and ease of doing business.

E-Government and Digital Society: Estonia has embraced digitalization, offering a wide range of e-government services. The e-residency program allows foreign entrepreneurs to establish and manage businesses online, streamlining processes like company registration, tax filing, and document signing.

Ease of Doing Business: Estonia consistently ranks high in global ease of doing business indices. The country's efficient bureaucracy, straightforward regulations, and minimal red tape contribute to a business-friendly environment.

Flat Tax System: Estonia operates on a flat tax system, with a single corporate income tax rate of 22%. This simplicity attracts businesses, as it eliminates complexities associated with progressive tax systems.

We have also recorded a webinar where we talk more about the business climate in Estonia and who may benefit the most by doing business in Estonia.

In Estonia, establishing a company requires careful consideration of share capital requirements. Unlike some jurisdictions that mandate a substantial initial investment, Estonia follows a more flexible approach. The standard minimum share capital is set at a symbolic value of one euro. This means that entrepreneurs can start a business without the burden of significant upfront capital.

The nominal share capital represents the financial commitment of the shareholders to the company. However, it's important to note that this does not reflect the actual funds injected into the business. The one-euro requirement aims to encourage entrepreneurship and simplify the company formation process.

The payment process for share capital contributions in Estonia is designed to be streamlined and efficient. Shareholders can contribute their share capital via bank transfer or other approved methods. The company must then provide proof of payment to the Estonian Business Register, which typically involves submitting a digitally signed statement from the bank confirming the transaction. In cases where the share capital contribution exceeds 50,000 euros, additional documentation may be required, such as a valuation report for non-monetary contributions. The Estonian Business Register typically reviews and approves share capital contributions within a few days.

Once the share capital is determined, the next step involves the payment process. In Estonia, the payment can be made in cash or non-monetary contributions, such as assets or services, contributing to the flexibility of the system.

The payment process is relatively straightforward. Shareholders transfer the agreed-upon amount to the company's bank account. It's essential to ensure that the payment aligns with the share capital specified in the company's Articles of Association. The simplicity of this process is a testament to Estonia's commitment to fostering a business-friendly environment.

Furthermore, the country's advanced digital infrastructure streamlines financial transactions. Entrepreneurs can initiate and track payments seamlessly through online banking services, promoting efficiency and transparency.

While the low share capital requirement is advantageous, entrepreneurs should carefully assess their business needs and financial plans. It's advisable to determine a share capital that aligns with the company's projected activities and future growth.

We have written a comprehensive blog article about VAT in Estonia.

Demystifying Value Added Tax (VAT) in Estonia: A Simple Guide

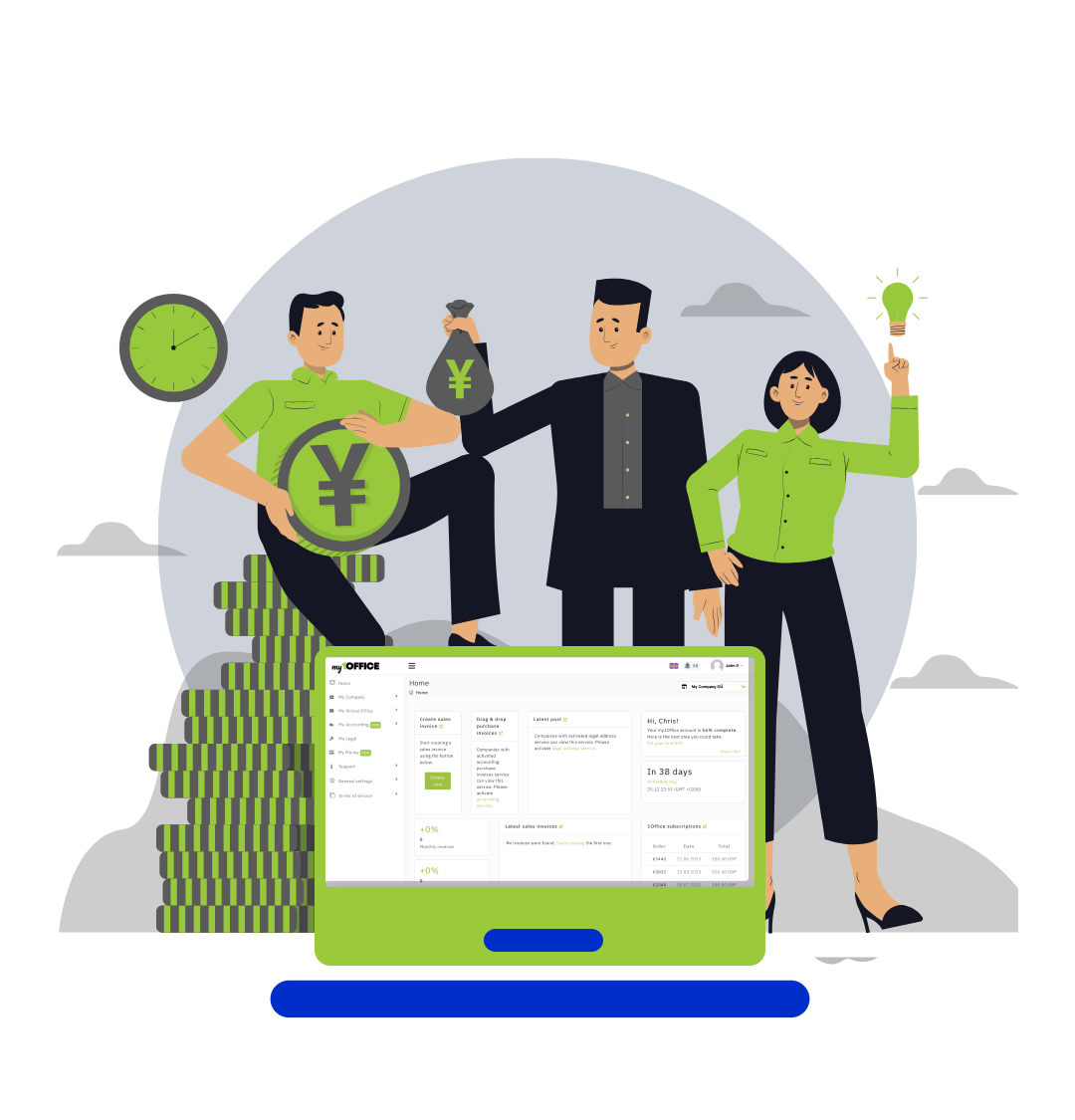

Using the my1Office platform for easy company management can provide you with several benefits, including:

Overall, the my1Office platform provides a comprehensive and user-friendly solution for managing all aspects of your company in Estonia. It simplifies administrative tasks, enhances financial visibility, and ensures compliance with regulations, allowing you to focus on growing your business and achieving your goals.

Adding {{itemName}} to cart

Added {{itemName}} to cart

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!